Nebraska Personal Property Tax Rates . Nebraska has an inheritance tax. the average effective property tax rate in nebraska is 1.61%, which ranks among the 10 most burdensome states in the country. nebraska personal property return must be filed with the county assessor on or before may 1. Nebraska has a 30 cents per gallon. (1) the kind of property that is taxed (and exempted from tax), (2) assessment and. Compare value and tax current and prior. of nebraska’s property tax system: All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. The personal property tax in nebraska makes.

from www.armstrongeconomics.com

All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. Nebraska has an inheritance tax. nebraska personal property return must be filed with the county assessor on or before may 1. Compare value and tax current and prior. of nebraska’s property tax system: the average effective property tax rate in nebraska is 1.61%, which ranks among the 10 most burdensome states in the country. (1) the kind of property that is taxed (and exempted from tax), (2) assessment and. The personal property tax in nebraska makes. Nebraska has a 30 cents per gallon.

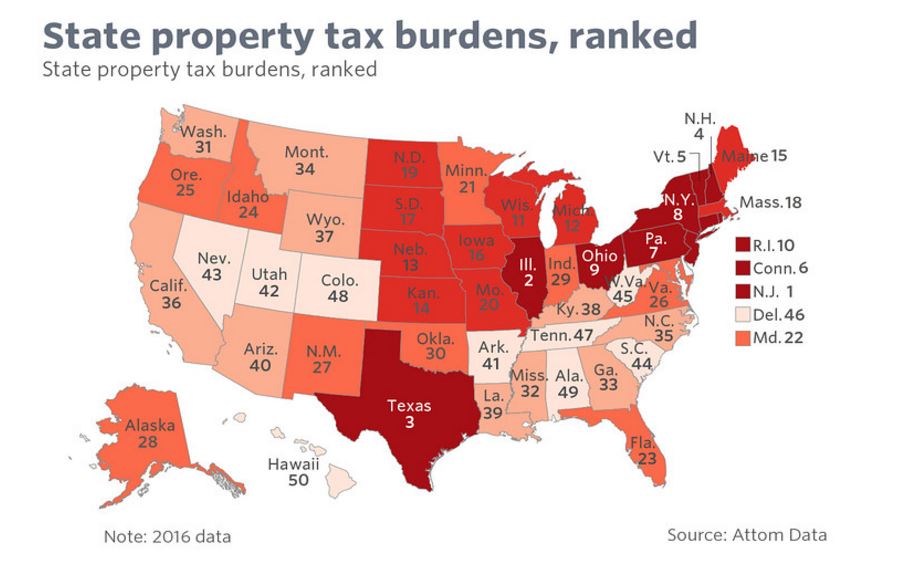

US Property Tax Comparison by State Armstrong Economics

Nebraska Personal Property Tax Rates nebraska personal property return must be filed with the county assessor on or before may 1. Compare value and tax current and prior. of nebraska’s property tax system: Nebraska has a 30 cents per gallon. All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. Nebraska has an inheritance tax. nebraska personal property return must be filed with the county assessor on or before may 1. The personal property tax in nebraska makes. (1) the kind of property that is taxed (and exempted from tax), (2) assessment and. the average effective property tax rate in nebraska is 1.61%, which ranks among the 10 most burdensome states in the country.

From taxfoundation.org

A TwentyFirst Century Tax Code for Nebraska Tax Foundation Nebraska Personal Property Tax Rates Nebraska has a 30 cents per gallon. The personal property tax in nebraska makes. Nebraska has an inheritance tax. of nebraska’s property tax system: nebraska personal property return must be filed with the county assessor on or before may 1. All depreciable tangible personal property, used in a trade or business, with a life of more than one. Nebraska Personal Property Tax Rates.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services Nebraska Personal Property Tax Rates All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. (1) the kind of property that is taxed (and exempted from tax), (2) assessment and. Compare value and tax current and prior. of nebraska’s property tax system: the average effective property tax rate in nebraska. Nebraska Personal Property Tax Rates.

From persprop.azurewebsites.net

About Nebraska Personal Property Nebraska Personal Property Tax Rates the average effective property tax rate in nebraska is 1.61%, which ranks among the 10 most burdensome states in the country. nebraska personal property return must be filed with the county assessor on or before may 1. (1) the kind of property that is taxed (and exempted from tax), (2) assessment and. Nebraska has an inheritance tax. Compare. Nebraska Personal Property Tax Rates.

From www.templateroller.com

Nebraska Personal Property Return Nebraska Net Book Value Fill Out Nebraska Personal Property Tax Rates (1) the kind of property that is taxed (and exempted from tax), (2) assessment and. of nebraska’s property tax system: Compare value and tax current and prior. The personal property tax in nebraska makes. nebraska personal property return must be filed with the county assessor on or before may 1. Nebraska has a 30 cents per gallon. Nebraska. Nebraska Personal Property Tax Rates.

From dailysignal.com

How High Are Property Taxes in Your State? Nebraska Personal Property Tax Rates the average effective property tax rate in nebraska is 1.61%, which ranks among the 10 most burdensome states in the country. Nebraska has a 30 cents per gallon. Compare value and tax current and prior. Nebraska has an inheritance tax. nebraska personal property return must be filed with the county assessor on or before may 1. The personal. Nebraska Personal Property Tax Rates.

From taxfoundation.org

Tangible Personal Property State Tangible Personal Property Taxes Nebraska Personal Property Tax Rates Nebraska has an inheritance tax. the average effective property tax rate in nebraska is 1.61%, which ranks among the 10 most burdensome states in the country. of nebraska’s property tax system: Compare value and tax current and prior. All depreciable tangible personal property, used in a trade or business, with a life of more than one year is. Nebraska Personal Property Tax Rates.

From taxfoundation.org

How Does Your State Rank on Property Taxes? 2019 State Rankings Nebraska Personal Property Tax Rates All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. Compare value and tax current and prior. The personal property tax in nebraska makes. the average effective property tax rate in nebraska is 1.61%, which ranks among the 10 most burdensome states in the country. (1). Nebraska Personal Property Tax Rates.

From platteinstitute.org

Death and Taxes Nebraska’s Inheritance Tax Nebraska Personal Property Tax Rates The personal property tax in nebraska makes. Compare value and tax current and prior. nebraska personal property return must be filed with the county assessor on or before may 1. Nebraska has a 30 cents per gallon. (1) the kind of property that is taxed (and exempted from tax), (2) assessment and. All depreciable tangible personal property, used in. Nebraska Personal Property Tax Rates.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Nebraska Personal Property Tax Rates nebraska personal property return must be filed with the county assessor on or before may 1. (1) the kind of property that is taxed (and exempted from tax), (2) assessment and. Nebraska has an inheritance tax. All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net.. Nebraska Personal Property Tax Rates.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Nebraska Personal Property Tax Rates Nebraska has a 30 cents per gallon. nebraska personal property return must be filed with the county assessor on or before may 1. Compare value and tax current and prior. All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. Nebraska has an inheritance tax. . Nebraska Personal Property Tax Rates.

From nebraskaexaminer.com

Nebraska's tax system is 'upside down,' report says, with higher Nebraska Personal Property Tax Rates Compare value and tax current and prior. nebraska personal property return must be filed with the county assessor on or before may 1. of nebraska’s property tax system: Nebraska has a 30 cents per gallon. All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net.. Nebraska Personal Property Tax Rates.

From www.cloudseals.com

nebraska property tax rates by county Nebraska Personal Property Tax Rates All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. nebraska personal property return must be filed with the county assessor on or before may 1. Nebraska has an inheritance tax. (1) the kind of property that is taxed (and exempted from tax), (2) assessment and.. Nebraska Personal Property Tax Rates.

From www.cassne.org

Personal Property Return and Schedule Due On or Before May 1, 2019 (05 Nebraska Personal Property Tax Rates Nebraska has a 30 cents per gallon. nebraska personal property return must be filed with the county assessor on or before may 1. Nebraska has an inheritance tax. (1) the kind of property that is taxed (and exempted from tax), (2) assessment and. The personal property tax in nebraska makes. the average effective property tax rate in nebraska. Nebraska Personal Property Tax Rates.

From revenue.nebraska.gov

Nebraska Personal Property Return and Schedule Due On or Before May 1 Nebraska Personal Property Tax Rates nebraska personal property return must be filed with the county assessor on or before may 1. the average effective property tax rate in nebraska is 1.61%, which ranks among the 10 most burdensome states in the country. Nebraska has an inheritance tax. All depreciable tangible personal property, used in a trade or business, with a life of more. Nebraska Personal Property Tax Rates.

From taxfoundation.org

Best & Worst State Property Tax Codes Tax Foundation Nebraska Personal Property Tax Rates of nebraska’s property tax system: (1) the kind of property that is taxed (and exempted from tax), (2) assessment and. Nebraska has a 30 cents per gallon. Compare value and tax current and prior. The personal property tax in nebraska makes. All depreciable tangible personal property, used in a trade or business, with a life of more than one. Nebraska Personal Property Tax Rates.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Nebraska Personal Property Tax Rates Nebraska has an inheritance tax. Nebraska has a 30 cents per gallon. All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. of nebraska’s property tax system: nebraska personal property return must be filed with the county assessor on or before may 1. Compare value. Nebraska Personal Property Tax Rates.

From www.templateroller.com

Form PTC Download Fillable PDF or Fill Online Nebraska Property Tax Nebraska Personal Property Tax Rates Compare value and tax current and prior. The personal property tax in nebraska makes. of nebraska’s property tax system: the average effective property tax rate in nebraska is 1.61%, which ranks among the 10 most burdensome states in the country. Nebraska has an inheritance tax. Nebraska has a 30 cents per gallon. nebraska personal property return must. Nebraska Personal Property Tax Rates.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics Nebraska Personal Property Tax Rates (1) the kind of property that is taxed (and exempted from tax), (2) assessment and. Compare value and tax current and prior. All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. nebraska personal property return must be filed with the county assessor on or before. Nebraska Personal Property Tax Rates.